🐻 Real Examples: Surviving a Bear Market with Whisber

Every trader loves the bull market — prices rising, confidence growing, profits flowing.

But it’s the Surviving a Bear Market that truly test your discipline, patience, and emotional control. 😤📉

That’s where Chuchotement shines.

Our AI trend system isn’t built just for chasing pumps — it’s built to protect your capital, guide your timing, and keep you calm when the market turns red. ❤️🔥

Let’s walk through how Whisber helps users Surviving a Bear Market— and even thrive — during bear markets.

🧠 1. Seeing the Downtrend Before Everyone Else

Most traders only realize it’s a bear market after it’s too late — when prices have already crashed.

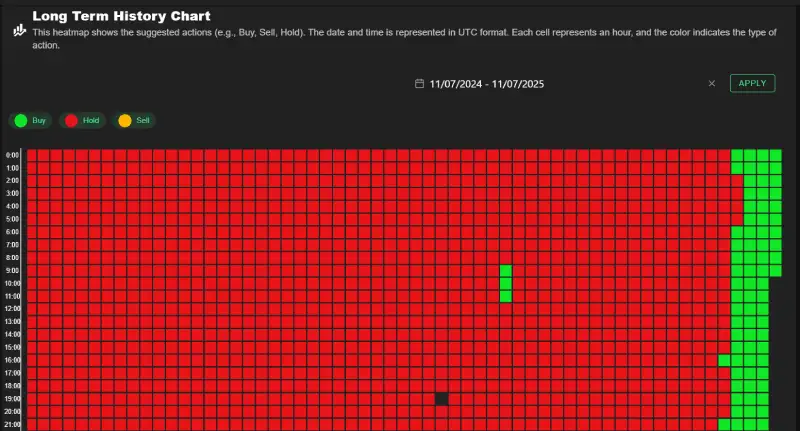

Whisber’s Long-Term Trend Heatmap and AI Gauges detect downtrend signals early, long before social media panic starts.

Example:

📊 When the Long-Term Dashboard turns from 🟢 Bullish to 🔴 Bearish, and the Short-Term also confirms 🔴, that’s your AI alert saying:

“The tide is turning. Protect your capital.”

Instead of holding and hoping, Whisber users start adjusting early — reducing exposure and waiting for strength to return.

✅ Result: Capital preserved. No panic selling.

⚙️ 2. Using “Suggested Actions” to Stay Calm

During bear markets, emotions swing wildly — fear, regret, revenge trading.

Whisber simplifies your choices with one line of guidance:

- 🔴 Sell — “The trend is weakening, secure your profits.”

- 🟡 Hold — “Market uncertain, stay patient.”

- 🟢 Buy — “Recovery signs appearing, prepare to re-enter.”

This keeps decisions objective, not emotional.

💡 You don’t need to time the exact bottom. You just need to follow the trend data calmly.

📈 3. Short-Term Trend as Your Early Recovery Signal

Even in Surviving a Bear Market, there are short-term rallies — mini uptrends that can help you rebuild or scalp profits safely.

Whisber’s Short-Term Trend Heatmap shows when momentum starts shifting green again 🟢.

Example:

If the market has been 🔴 for weeks but the Short-Term flips 🟢 and holds for several hours, it could mean:

“A short-term bounce is forming — but wait for Long-Term confirmation before going big.”

✅ Result: You catch recovery waves safely without getting trapped in fake breakouts.

🛡️ 4. Protecting Capital While Staying Ready

Whisber’s AI doesn’t just tell you when to buy — it tells you when not to trade.

During strong bearish cycles, the system might show consistent 🔴 “Sell” or “Downtrend” signals.

That’s your green light to do nothing — and that’s often the smartest move.

While others panic trade, Whisber users simply monitor the data, letting the AI guide them on when the storm is finally over. 🌧️➡️🌤️

💪 5. Turning Survival into Strategy

Bear markets aren’t permanent — they’re opportunities to prepare.

By following Whisber’s signals, you’ll know exactly when the next uptrend begins, because:

- Long-Term turns 🟢

- Short-Term confirms 🟢

- Suggested Action switches to Buy / Hold

At that moment, Whisber users are already positioned — while others are still afraid to re-enter.

🧩 Real-World Example Summary

| Market Phase | Whisber Signal | Action | Result |

|---|---|---|---|

| 🔴 Sharp decline starts | Bearish / Sell | Reduce exposure, protect profits | Avoided losses |

| 🟡 Sideways / Unclear | Hold | Wait for confirmation | No emotional trades |

| 🟢 Early recovery | Uptrend detected | Gradual re-entry | Ride next wave safely |

2) Example A — “Capital First”: Riding the Downtrend Safely

Scenario: Long-Term flips Bearish on BTC and stays red for weeks.

Dashboard:

- Gauge: Bearish

- Heatmap: long red wall with occasional 1–2 green blips

- Short-Term duration: frequently rising on red (momentum down)

Plan:

- Exit/trim longs on the Sell call.

- Stay flat until Short-Term shows 3–6 green in a row and Long-Term softens to Neutral/Bullish.

Why it works: You avoid death-by-a-thousand-cuts from every “mini bounce.” You only wake up for persistence, not noise.

Numbers (illustration):

- Account $1,000 → risk 1% = $10

- If you short: Entry $100, Stop $101 (distance $1) → size = 10 units

- Partial profit at +1.0%, scale again at +2.0%, keep a small runner while Short-Term stays red

3) Example B — “Countertrend, But Controlled”

Scenario: Long-Term still Bearish, but Short-Term prints 6 green in a row (a bounce).

Dashboard:

- Gauge: Short-Term Uptrend; Duration = 6h

- Heatmap: green cluster after a long red wall

Plan (small size only):

- Take a toe-dip long with half risk, stop under latest swing low.

- Targets tight: TP1 +0.8%, TP2 +1.8%, exit remainder on red flip.

Why it works: You respect the bear regime (small size), but you can harvest structured bounces without FOMO.

Numbers:

- Risk 0.5% = $5 max loss

- Entry $50, Stop $49.60 (distance $0.40) → size = 12 units

- TP1 $50.40 (sell 6), TP2 $50.90 (sell 5), keep 1 runner; flip to 🔴 = exit

4) Example C — “The Turn”: Spotting a Real Regime Change

Scenario: After months red, the heatmap shifts from red wall → green wall, and the Long-Term gauge moves from Bearish → Bullish.

Dashboard:

- Heatmap: 24–72h of mostly green

- Gauge: Long-Term Bullish, Short-Term Uptrend with rising duration

- Suggested Action: Buy/Hold

Plan:

- Start a core position (normal size).

- Add on pullbacks while Short-Term remains 🟢.

- Trail stops under higher swing lows; scale out into strength.

Why it works: You waited for confirmation (clusters + Long-Term flip), not the first green dot. That saves you from false bottoms.

FAQ

Should I DCA during bears?

Only if your Long-Term plan says so and you accept drawdown. For trading, use signals, not calendar.

How do I know if the bottom is real?

Look for persistence: green clusters for days + Long-Term gauge turning Bullish. Single blips are traps.

Can I just stay in cash?

Yes. That’s a valid bear-market strategy. Set alerts so you’re notified when a real turn arrives.