📊 Understanding the Long-Term Trend

Long-term trend analysis is the heart of Whisber’s AI system.

It helps you see the bigger picture — not just where the market is today, but where it’s been heading for weeks -> even months -> sometimes up to years .

This is your roadmap for making calm, strategic crypto decisions — without reacting to daily noise.

🧠 What Is the Long-Term Trend?

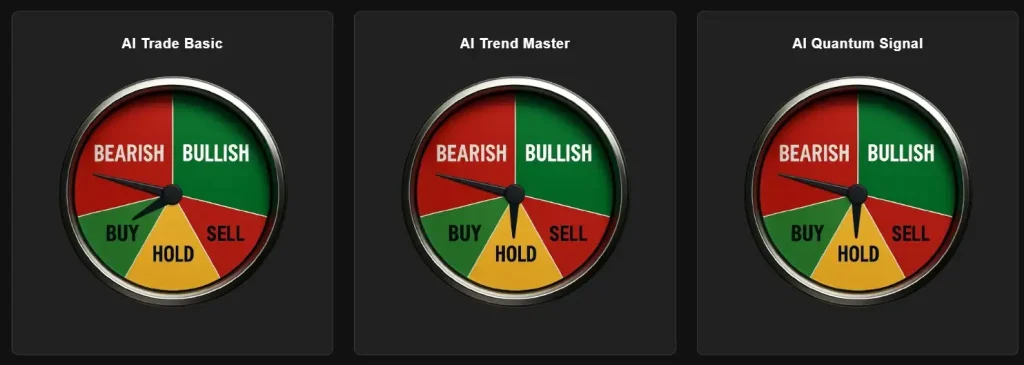

A simple dial with two zones—Bearish or Bullish, Buy and Hold or Sell—and a needle pointing to the current guidance for that asset on the Long-Term Trend timeframe.

How to read it:

Bearish + Hold → Don’t add risk; wait for the next Long-Term Trend flip.

Bullish + Buy → Market trend is up; add or hold long exposure.

Bullish + Hold → Uptrend intact; don’t chase—manage existing positions.

Bearish + Sell → Downtrend dominant; reduce exposure/hedge.

Think of it as your AI compass 🧭 — showing whether you’re sailing with or against the current.

🧩 3 Levels of AI Models

Whisber includes multiple AI models working together for deeper confirmation 👇

- AI Trade Basic → clear Long-Term Trend state (good for investors).

- AI Trend Master → smoother timing suggestions (enter/exit discipline).

- AI Quantum Signal → stricter noise-reduction and faster anomaly detection (power users).

When all three align bullish 🟢, it’s a strong confirmation that the uptrend is forming.

When they all show red 🔴, it’s time to stay defensive or reduce exposure.

📟 The Trend Meters

You’ll also notice AI Trend Gauges on your dashboard like these 👇

These visual dials summarize Whisber’s trend analysis into clear indicators:

- Bearish → The market is weak. Prioritize capital protection.

- Bullish → Strength building. Look for buying opportunities.

- Buy / Hold / Sell → Suggested action based on AI confidence.

Each gauge instantly shows where the market stands — no chart-reading skills required.

🔥 How to Read the Chart

Below is the Long-Term Trend History Chart, also known as the AI Trend Heatmap 👇

🟢 = Buy

🟡 = Hold

🔴 = Sell

Each small square represents a specific hour in time. Together, they form a timeline of Whisber’s suggested actions over months.

🖼 Long Term Trend Heatmap:

In this heatmap:

- The red blocks (🟨) suggest Hold/Neutral — periods of market indecision or consolidation. Do not do anything.

- The green blocks (🟩) toward the right side mark the transition into a Buy phase — signaling a potential recovery or start of a bullish wave.

- The Yellow blocks (🟥) show a continuous Sell signal — indicating a long-term bearish period where it’s safer to preserve capital.

- Dark cells ⬛ means Muted data/ data not available. Just ignore.

🧩 Each block = 1 hour, so you can visually track how trends evolved and when the market momentum changed.

⚙️ How the AI Calculates It

Whisber’s AI scans and processes:

- 📈 Price momentum across multiple timeframes

- 💰 Market volume trends

- 🧭 Moving averages and volatility shifts

- 🧠 Historical data patterns

The result? A smoothed, data-driven long-term signal that tells you when to accumulate, hold, or sit out.

🧩 Why Long-Term Trend Matters

Many traders lose money by reacting to short-term noise.

Whisber’s Long-Term Trend helps you:

✅ Avoid emotional overtrading

✅ Focus on stable market direction

✅ Time your entries and exits better

✅ Protect capital during prolonged bearish phases

By aligning with the long-term trend, you make fewer trades — but smarter ones.

💡 Pro Tip

If the Long-Term Heatmap turns green while AI Trend Gauges confirm bullish momentum, it’s usually a strong indication of a potential trend reversal.

This is when patience pays off — let Whisber guide your timing.

From Signal to Action

Base rules (long-term investors):

- Bias: Trade with the color.

- Mostly 🟩? Favor long exposure.

- Mostly 🟥? Preserve capital or hedge.

- Entries: Add on the first solid cluster of 🟩 after a long red period.

- Exits: De-risk on the first solid cluster of 🟥 after a long green period.

- Management: During 🟨 Hold, avoid FOMO entries; manage positions (trail stops / take partial profits).

Sizing & risk (example):

- Max 3–5 core positions.

- Size 2–5% per asset; wider stops in long-term than in short-term.

- Take profits in ladders (e.g., +10% / +25% / +40%) instead of all-in/all-out.

Spotting a Major Flip

- Scan the rightmost column(s)—that’s the most recent period.

- Count clusters, not single squares. A few stray greens inside a red wall aren’t a regime change.

- Look for persistence: 24–72 consecutive hours of mostly 🟩 = meaningful shift to bull; same logic for 🟥 turning bear.

- Confirm with the gauge: Heatmap says green cluster and the gauge needle points Bullish/Buy? That’s your go signal.

In the provided heatmap, you can see a long stretch of 🟥 (sell) that transitions into a tall band of 🟩 on the far right—this is what a major long-term flip looks like.

How Long-Term and Short-Term Work Together

- Use Long-Term to set your market bias (macro direction).

- Use Short-Term to time entries inside that bias.

- Example: Long-Term turns Bullish → switch to Short-Term for entry triggers; if Short-Term dips red briefly, you wait for it to re-align green to add.

FAQ

Is the heatmap a backtest?

It’s a record of live signal states over time (hourly). Use it to understand regime duration and to avoid overreacting to short blips.

Can I just buy whenever it turns green?

Have a plan. Green suggests with-trend exposure, but you still need sizing, stops, and take-profit rules.

What if green turns back to red quickly?

That’s a false start. Wait for persistence (clusters) and confirm with the gauge before committing size. But for AI Quantum Signal , this might be happened and it is not a false signal.

Ready to use Long-Term like a pro?

- View the Long-Term Gauge for your top coins.

- Scan the heatmap for persistent clusters.

- Turn on Buy/Sell flip alerts so you never miss a regime change.

Let Whisber watch the market. You focus on following your rules.